Investment Strategy

The TGC INVESTMENT STRATEGY

Women or Minority owned and/or managed based in the American South region; opportunistically businesses solely focused on LMI areas

TARGET COMPANIES

- Minimum Revenue of $2 Million

- EBITDA up to $6 Million

- Minimum of 3 years operating history

INDUSTRY FOCUS

- Transportation & Logistics

- Manufacturing and Distribution

- Renewable Energy

- Business Services

- Infrastructure Services

- Businesses solely focused LMI areas

OTHER ATTRIBUTES

- Scalable Business Model

- Management team open to active engagement

- Diversified Customer Base

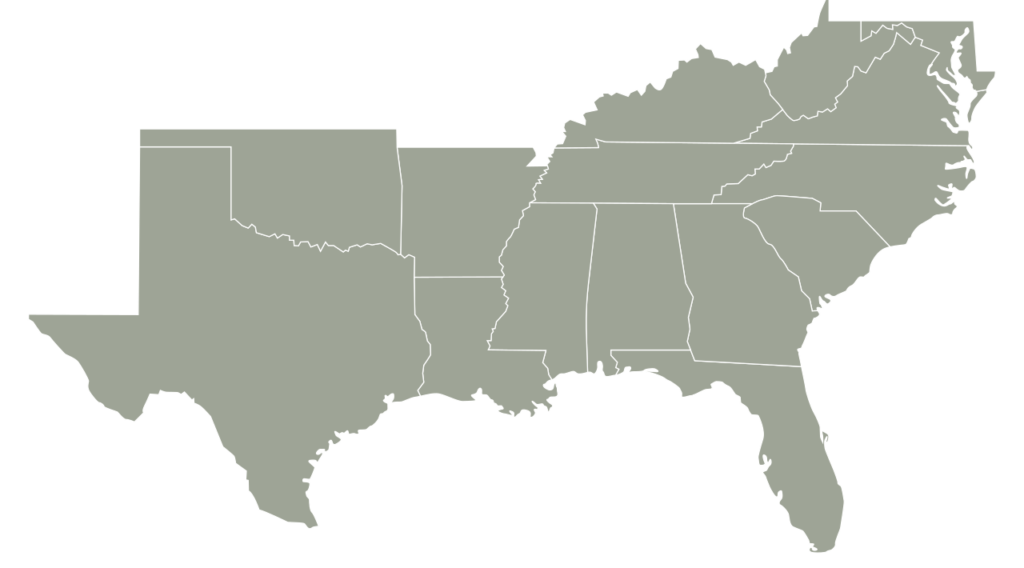

ALABAMA · ARKANSAS · DISTRICT OF COLUMBIA · FLORIDA · GEORGIA · KENTUCKY · LOUISIANA · MARYLAND . MISSISSIPPI · NORTH CAROLINA · OKLAHOMA · SOUTH CAROLINA · TENNESSEE · TEXAS · VIRGINIA · WEST VIRGINIA

Help us bring transformational growth capital to the new american south.

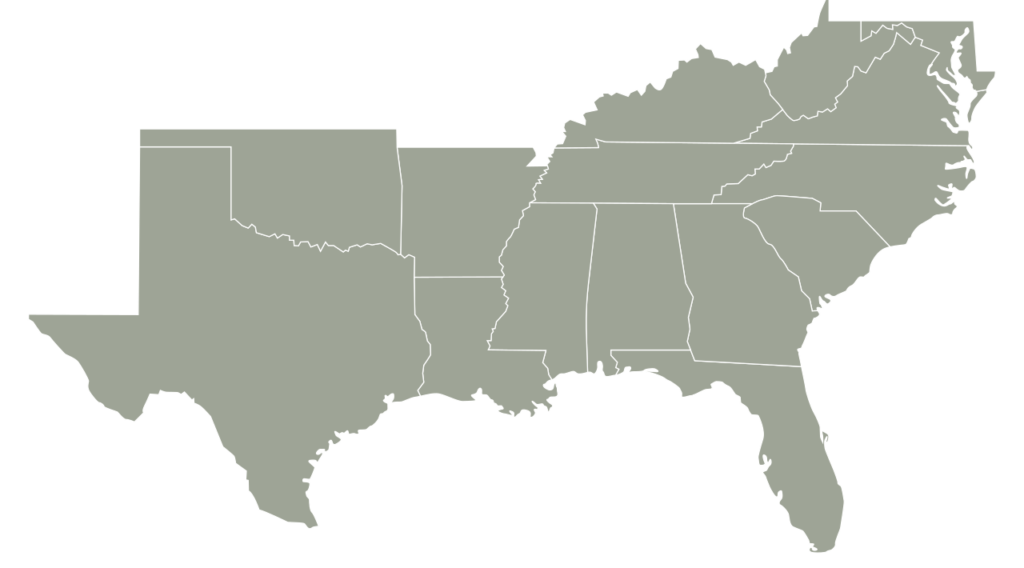

- ALABAMA

- ARKANSAS

- DISTRICT OF COLUMBIA

- FLORIDA

- GEORGIA

- KENTUCKY

- LOUISIANA

- MARYLAND

- MISSISSIPPI

- NORTH CAROLINA

- OKLAHOMA

- SOUTH CAROLINA

- TENNESSEE

- TEXAS

- VIRGINIA

- WEST VIRGINIA

Minimum Of Three Years

In business with demonstrated growth and opportunity to scale

EBITDA

History of Positive Cash Flow – $6M

INDUSTRY FOCUS

Transportation & Logistics, Manufacturing and Distribution, Renewable Energy, Business Services, Infrastructure Services, and businesses solely focused LMI areas

OTHER ATTRIBUTES

Scalable business model

Management team open to active engagement

The TGC INVESTMENT STRATEGY

Women or Minority owned and/or managed based in the American South region; opportunistically businesses solely focused on LMI areas

ALABAMA · ARKANSAS · DISTRICT OF COLUMBIA · FLORIDA · GEORGIA · KENTUCKY · LOUISIANA · MARYLAND . MISSISSIPPI · NORTH CAROLINA · OKLAHOMA · SOUTH CAROLINA · TENNESSEE · TEXAS · VIRGINIA · WEST VIRGINIA

quick links

All Rights Reserved.